Have you ever imagined owning a piece of paradise—where your investment doesn’t just grow, but thrives? A place where opportunity ripens in no time, and even first-time investors can find success in a booming, welcoming market? Welcome to Bali, a tropical haven that has become one of the fastest-growing and most lucrative real estate markets in the world.

Bali’s property sector has experienced record-breaking growth, with a 30% increase in transactions in 2024 alone. Thanks to the island’s booming tourism industry, thriving digital nomad scene, and ever-growing expat community that the island has seen surging demand for properties, from luxury beachfront villas to high-yield rental homes. In prime locations like Canggu and Seminyak, property values are expected to appreciate by 15-20% annually, making Bali a goldmine for real estate investors.

But is buying land in Bali really a good investment? And why should you take advantage of Bali’s real estate opportunities now?

Let’s dive into five compelling reasons why investing in Bali’s real estate market is a smart move.

Own your COCO property in paradise with benefits for life

- +200 properties in construction

- +250 properties in full operation

- Pay 20% of your property straight from rental profit

Why Are Investors Flocking to Invest in Bali Real Estate Market?

Over the last couple of years, Bali’s property market has been gaining ground among the local as well as international investors. The surge can be linked to a few key reasons:

1. High Return on Investment (ROI) and Affordability

Bali offers some of the highest rental yields in Southeast Asia, making it an attractive option for property investors. Its real estate scene is showing strong potential for returns, with property values consistently rising and rental demand growing each year. This sets the stage for investors to see impressive returns on property ROI, especially in up-and-coming tourist spots and expat-friendly areas.

Profitable rental market

Bali’s booming tourism industry continues to drive a strong and consistent demand for rental properties, making it a prime destination for investors seeking steady, passive income. With no signs of decline, market trends and historical data indicate that long-term rental properties in Bali are projected to yield a minimum of 7-10% annual returns, while short-term vacation rentals in high-demand areas like Ubud, Seminyak, and Canggu can generate at least 15-20%. And the best part is: as visitor numbers continue to surge, these returns are expected to remain stable—or even increase—in the coming years.

Lower property costs

Compared to other luxury property hubs, Bali’s real estate prices are relatively affordable, allowing investors to enter the market without excessive capital. In fact, when compared to international property markets, Bali is still pretty budget-friendly, giving investors the opportunity to get in the market early and enjoy the potential for high ROI while spending less.

For instance, investors can enter Bali’s real estate market with as little as $100,000, securing a property that can be rented out on platforms like Airbnb or Booking.com, depending on ownership arrangements. This low upfront cost, combined with steady property appreciation and high rental demand, makes Bali an exceptional choice for those looking to build passive income streams in a thriving market.

Favorable tax policies

Indonesia offers lower property taxes compared to many Western countries, which adds another financial advantage to investing in Bali. Foreign investors benefit from lower annual property tax rates (around 0.5% of property value) and relatively minimal capital gains taxes, making property ownership in Bali more cost-efficient in the long run. These favorable tax policies ensure that investors retain more of their earnings compared to investment destinations with higher tax burdens.

Easy market entry

Unlike other Southeast Asian countries that impose strict foreign ownership regulations, Bali provides accessible investment pathways, making it easier for both seasoned and first-time investors to enter the market. Leasehold agreements (Hak Sewa) and corporate ownership structures (PMA) allow foreign buyers to acquire properties legally and securely. This investor-friendly environment ensures that buying and managing real estate in Bali is straightforward and profitable, attracting a global pool of property buyers.

2. Booming Tourism and Expat Community

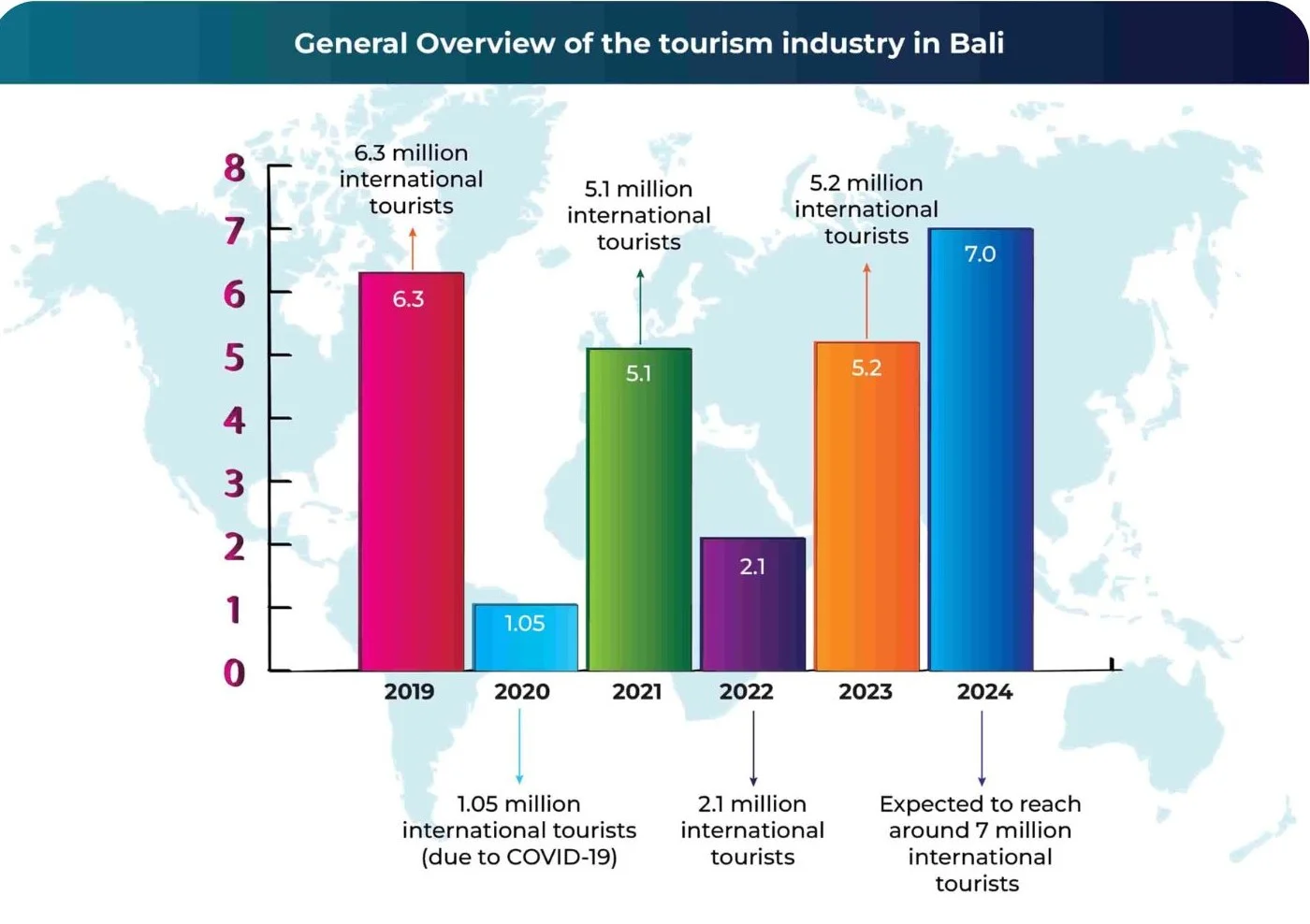

Bali’s thriving tourism industry and expanding expat community ensure a continuous and growing demand for rental properties. The island remains a top global destination, attracting over 5.2 million international tourists in 2023, marking a 144.61% increase from the previous year. This surge is expected to continue, with projections surpassing 7 million visitors in 2025, exceeding pre-pandemic levels.

Additionally, Bali is home to over 40% of Indonesia’s expat population, solidifying its reputation as a hub for digital nomads and remote workers. And this only means one thing: a steady influx of long-term residents fueling demand for luxury villas, eco-resorts, and long-term rental properties—making Bali an increasingly attractive investment destination.

Beyond tourism, Bali is evolving into an entrepreneurship hub, with increasing investments in co-working spaces, commercial properties, and business retreats. The island’s pro-business environment has encouraged startups and established companies alike to set up operations, driving demand for both residential and commercial real estate. If current trends persist, rental demand for both short-term and long-term properties—residential and commercial—could double by 2025, ensuring stable cash flows and strong property appreciation for investors.

why investors choose

coco development group?

Passive income on full auto pilot

Profit Maximization

We do not just put your property on Airbnb hoping for a guest to book it. More than 40% of our bookings comes today through our own medias, a strong community and a digital and data driven management approach.

A Convenient and fast payment system

The investors receive net profits currency that is convenient for them. we transfer the money once every three months

No need to handle taxes

High Liquidity

Fast Payback

Oceanside villas in Bali are in High demand for daily rentals. You will earn about 5000 USD per month

3. Active Government Support and Infrastructure Development

The Indonesian government is taking bold steps to boost real estate investment in Bali, continuously improving infrastructure and accessibility. These upgrades not only enhance Bali’s appeal to tourists and expats but also open up prime opportunities for property investors looking to capitalize on a rapidly growing market.

Expanding Infrastructure

At present, the Balinese government is making significant strides in upgrading road networks, communication systems, and utilities, ensuring smoother mobility for both locals and visitors. Ongoing and upcoming projects, such as airport expansions, new toll roads, and improved public transport, are set to make key investment zones even more accessible—ultimately streamlining business operations and increasing demand for rental properties.

Rising Property Values

Development efforts aren’t just concentrated in tourist hotspots; emerging areas like Uluwatu and Nusa Dua are also receiving major attention. With rapid infrastructure improvements underway, these locations are experiencing notable capital appreciation. As these areas continue to evolve, it’s only a matter of time before property values surge, making them highly attractive investment prospects.

4. Favorable Business Climate and Sustainability Market

Bali retains the business-friendly climate in terms of profitability for local and international investors due to a vibrant and investor-friendly environment. In general, the island enjoys fast economic growth, ongoing improvements in industry and residence, and high ease of doing business. Additionally, low operational costs render the investment profitable in comparison to what other islands or regions offer.

Pro-Investment Policies and Streamlined Regulations

The Indonesian government actively supports foreign investment through pro-investment policies and simplified regulations. Real estate laws, for instance, allow foreigners to acquire assets through secure leasehold agreements, making property investment both accessible and structured for long-term ownership.

Global Wellness and Sustainability Hub

Business-wise, Bali has also cemented itself as a leader in wellness tourism, being home to world-renowned yoga retreats, meditation centers, and holistic resorts. This growing sector attracts investors looking to capitalize on the increasing demand for wellness-focused accommodations. Simultaneously, the rise of eco-friendly villas and sustainable property developments aligns with global trends in responsible tourism, making Bali a hotspot for ethical and future-forward investments.

Affordability and High Quality of Living

Compared to other luxury investment destinations, Bali offers a lower cost of living while maintaining high-quality amenities and infrastructure. This affordability factor makes it an attractive option for investors seeking profitable opportunities without the steep price tags seen in other international markets.

5. Post-Pandemic Market Resilience and Future Growth

Lastly, Bali’s real estate market has proven to be incredibly resilient, showing rapid recovery post-pandemic and continuous appreciation in property values.

Stable economic and political environment

As mentioned, Indonesia’s government actively promotes investment through pro-business policies, ensuring a secure and stable environment for property buyers.

The country is also economically stable, ranking among Southeast Asia’s fastest-growing economies, with GDP projected to grow by 5.2% in 2025. This economic strength reinforces investor confidence and contributes to Bali’s thriving property market.

Investment meets leisure

The best part? Beyond financial returns and portfolio diversification, investing in Bali offers the unique advantage of owning a personal vacation home in one of the world’s most sought-after tropical destinations. Investors can enjoy their property while it generates income when rented out, making it the perfect blend of leisure and financial growth.

Construction you can trust

We handle all the details – no hassle for you.

5 Years full warranty

20+ Finished developments in Bali by our team

25+ Years of shared experience

Strategies and Tips for Maximizing ROI

Maximizing your return on investment requires a strategic approach. Here are some key strategies to ensure you get the most out of your property investment in Bali:

Tailored Investment Strategies: Matching Property Goals to Market Needs

To maximize ROI, you must align your property investment goals with the specific needs of your target market. If your goal is to generate passive income, investing in short-term vacation rentals in tourist-heavy areas like Seminyak and Canggu may be ideal due to their high occupancy rates. If long-term growth is your focus, purchasing in up-and-coming areas like Umalas or Mengwi where infrastructure development is increasing could offer higher capital appreciation in the future.

Budget Planning and Negotiation Tips:

Budget planning alongside negotiation is an essential skill for securing the best property deals.

- Create a Contingency Fund: Always set aside an additional 10% to 20% of your budget to cover unexpected expenses such as repairs, regulatory changes, or market fluctuations.

- Consider Financing Options: While most property transactions in Bali are cash-based, some developers offer payment plans or financing solutions for foreign investors, making entry to the market more accessible.

- Leverage Market Knowledge and Working with Experts: Knowing the current market trends and property values in the area will give you an edge in negotiations. Partnering with experienced lawyers and real estate agents familiar with Bali’s property market also is recommended to minimize risks.

- Be Ready to Walk Away: Most importantly, if a deal doesn’t meet your requirements or expectations, be prepared to explore other options.

Market Timing: Investing Early in Growth Areas to Get the Best ROI

Investing early in emerging areas offers significant upside potential. Areas like Cemagi, Sidemen, and Nyanyi are still in the early stages of development but are showing promising growth due to infrastructure improvements and increasing demand. Getting in on the ground floor allows investors to capitalize on appreciation as these areas develop further.

Diversification: Combining Primary and Emerging Markets for a Balanced Portfolio

By diversifying your investments across both established property hotspots (like Canggu or Seminyak) and emerging areas (such as Umalas or Mengwi), you can balance steady rental income with high capital appreciation potential. This strategy reduces risk and maximizes overall returns.

FAQ

Yes, foreigners can invest in Bali real estate through leasehold agreements or by setting up an Indonesian company (PT PMA) to acquire freehold property.

High-demand locations include Canggu, Seminyak, Uluwatu, Ubud, and Nusa Dua, all offering strong rental yields and high appreciation rates.

Prices vary depending on the location, but affordable leasehold properties can start from as low as $50,000, while luxury villas can cost several million dollars.

Like any investment, Bali real estate comes with some risks, such as regulatory changes or market fluctuations. However, working with a reliable local agent and legal consultant can mitigate these risks.

Both options have advantages: land purchases offer long-term appreciation, while built properties generate immediate rental income. The best choice depends on your investment goals.

No Taxes, No Hassle: COCO Handles Everything for Your Property

Let COCO Development Group take the stress out of property ownership. From accounting to tax optimization and payments, we handle every detail, so you enjoy hassle-free profits straight to your account.

Enter the Market Confidently!

Bali’s real estate market is one of the most lucrative and promising investment opportunities in the world today. With high ROI, booming tourism, government support, a thriving wellness market, and post-pandemic resilience, now is the perfect time to tap into Bali’s real estate potential.

Whether you’re looking to build your dream villa, earn passive income from rentals, or secure a high-value property for the future, Bali offers incredible opportunities for every type of investor.

Are you ready to make your move in Bali’s thriving real estate market?

Rasmus Holst is a serial entrepreneur and Co-Founder of COCO Development Group, where he helps drive innovation and growth through strategic business development. He is also the Co-Founder of Estate of Bali and Regnskabshelten.dk, Denmark’s fastest-growing accounting firm, which grew to 35 employees and generated $2.5M in turnover in 2023. Rasmus is passionate about building businesses that create long-term value and impact.