Bali is much more than just a prime destination for property investors keen on receiving passive income in a tropical paradise. The island has the famous beaches, rich culture, and a booming tourism industry that make it a favorite not only among tourists and expatriates but also among savvy investors. Its real estate cash flow potential and favorable rental property ROI make it a very attractive investment opportunity for both novice and experienced actors, may it be local and international ones.

In this article, we’ll delve into the basics of passive income property investment, examine the growing appeal of Bali’s real estate market, go over important strategies to maximize returns, and highlight why Bali has become the go-to spot for investors seeking profitable, long-term property ventures

What is Passive Income Property Investment in Real Estate?

Passive income property investment involves earning steady returns from real estate without the need to oversee the property’s day-to-day operations. With this strategy, investors can enjoy returns based on properties that generate revenue gradually with minimal active participation. The income can come from multiple sources, including rental income, appreciation in property value, and business growth prospects.

In particular, real estate is inherently appealing for developing a passive income portfolio since it presents both stability and wealth growth. For many investors, the goal is to obtain properties that generate steady cash flow and increase in value, guaranteeing sustainable earnings.

Maximize Your ROI With Data-Driven Management

Benefit from our advanced marketing channels, strong community presence, and direct bookings that outperform standard Airbnb listings.

Why Are Investors Flocking to Bali for Passive Income Property Investments?

Over the last couple of years, Bali’s property market has been gaining ground among the local as well as international investors. The surge can be linked to a few key reasons:

Stable Market with High Return Potential

Bali’s real estate scene is showing strong potential for returns, with property values consistently rising and rental demand growing each year. This sets the stage for investors to see impressive returns on property ROI, especially in up-and-coming tourist spots and expat-friendly areas.

Lower Entry Costs Than Most Mature Markets

Bali’s property market is still pretty budget-friendly compared to other sought-after international destinations. This gives investors an opportunity to get in early, with lower property costs and the potential for high returns on investment.

If you’re thinking about entering Bali’s housing scene through buying a villa, apartment, or even some land, you’ll find that the prices here are way more reasonable than in established markets like Europe, North America, or Australia. You can actually enter the market with a budget of only $100,000 or less and snag a property to rent out on Airbnb or booking.com, depending on the type of property and ownership arrangements you’re considering. With this lower upfront cost, combined with solid appreciation rates, it’s a great place to set yourself up for some passive income on the island.

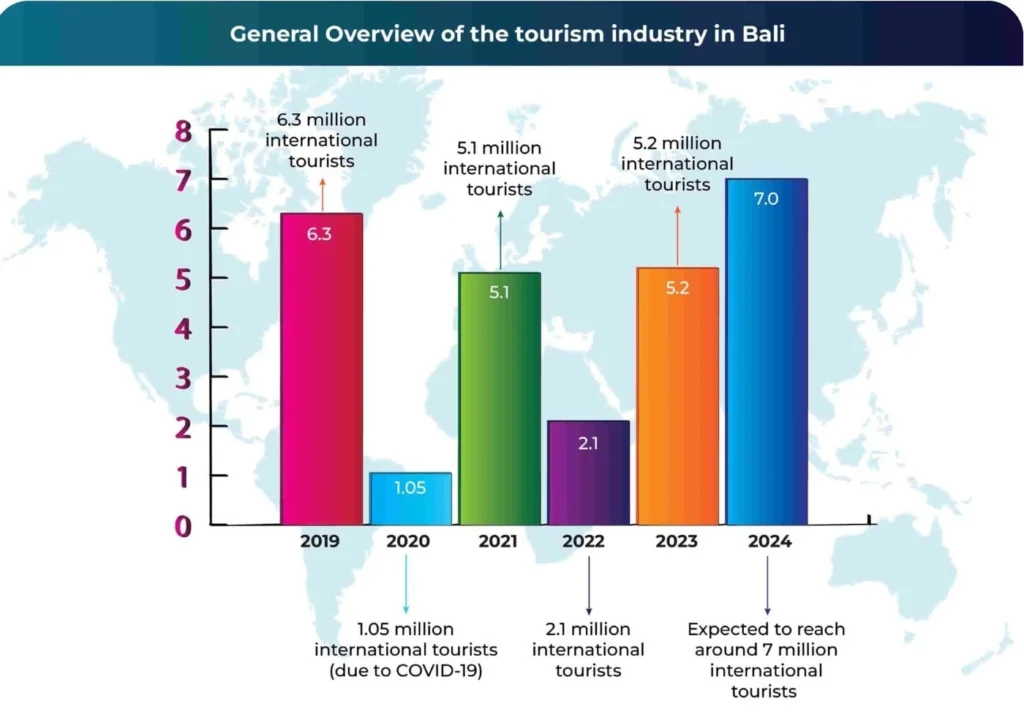

Boom in Tourism Industry

Bali remains at the forefront of global tourist spots, attracting millions of international visitors each year. After hitting rock bottom during the pandemic, Bali’s tourism industry has seen a remarkable recovery, welcoming more than 5.2 million international tourists in 2023 alone. This represented a 144.61% increase compared to the previous year and a consistent demand for a range of rental market options. If this trend persists as predicted in 2025, we can anticipate that the demand for rentals in both short-term and long-term properties will double compared to previous levels, promising stable cash flows for investors and overall elevated room for property appreciation.

Growing Infrastructure and Diverse Investment Opportunities

Bali’s expanding infrastructure plays a crucial role in its investment potential. At present, he Balinese government has been showing great effort in improving road quality, communication networks, and utilities, enhancing accessibility for both tourists and locals to get around. These enhancements not only boost Bali’s appeal to non-locals but also help businesses and rental properties run more smoothly.

Investing in Bali real estate is also not as frightening and difficult as it appears. As mentioned, you can consistently access the market at a fairly reasonable price, based on the property you wish to invest in. It is also very diverse, giving you the chance to mix up your portfolio while tapping into the high demand for both accommodations and commercial properties.

Whether you are thinking about putting money into residential properties, beachfront villas, popular cafes, or contemporary co-working spaces, which typically have nearly zero vacancy rates year-round, particularly during peak seasons, the potential for solid returns and long-term growth is huge. With Bali’s continuous infrastructure improvements, it’s only a matter of time before investors can fully tap into the vibrant and rapidly growing market of emerging tourist hotspots.

Location Relative to Major Tourist Destinations

Bali’s prime real estate locations are near some of the most iconic tourist attractions, pristine beaches, and cultural landmarks. Properties in these sought-after areas usually attract steady lines of visitors and long-term tenants, making it favorable to grow your assets. But, emerging areas should not be missed out either!

You can always choose your target market before deciding where to invest. For instance, if you would like to cater to nature lovers and wellness seekers, Ubud is a solid choice. If you’re leaning towards commercial properties like co-working spaces, trendy cafes, and retail outlets which appeal mostly to digital nomads and expats, then Canggu and Seminyak are the places to be. And if you’re after a mix of everything, you may want to look for properties in Kuta and Uluwatu.

Favorable Business Climate and Government Support

Bali retains the business-friendly climate in terms of profitability for local and international investors due to a vibrant and investor-friendly environment. In general, the island enjoys fast economic growth, ongoing improvements in industry and residence, and high ease of doing business. Additionally, low operational costs render the investment profitable in comparison to what other islands or regions offer.

Not only that, the government of Indonesia has further encouraged this invitation through its pro-investment policies and regulations. These regulations are also relatively straightforward, streamlining the investment processes. For instance, real estate laws have been designed to permit foreigners to acquire specific types of assets in the country by utilizing instruments such as leasehold purchases, thus offering an easy yet secure means of acquisition.

How Can You Generate Passive Income from Property Investments in Bali?

There are various means by which one can make money through passive income property investment in Bali. Key strategies include:

Value Appreciation

Rental Income

Commercial Rentals

Subleasing Land and Subletting Properties

Subleasing land and subletting properties in Bali can also be profitable options, particularly in tourism hotspots like Seminyak, Canggu, and Ubud. Subleasing involves renting out portions of leased land to businesses, generating steady returns while maintaining their primary lease and without having to develop the land yourself, may it be for agricultural purposes, tourism ventures, or even event holdings.

Subletting properties, on the other hand, through platforms like Airbnb and booking.com, enables tenants to profit from short-term rentals, such as villas and apartments. This trend is particularly in the hots as it caters to the expat community and digital nomads seeking to generate income that often exceeds the original lease cost.

However, it is important to note that its success relies on landlord approval, compliance with local laws, and effective property management. There are also risks to be considered before employing such strategies like unpredictable market fluctuations. Regardless, Bali’s strong tourism growth and rising expat population create a favorable environment for sustainable income, making these strategies highly rewarding with proper planning.

Buy and Hold Strategy

You might have heard the term “buy and hold” as a stock market investing term. It means you purchase a stock or some other asset and hang onto it, no matter if the market is up or down. This idea is pretty much the same with the buy and hold strategy in real estate.

Buy-and-hold strategy is the tactic of acquiring properties in rising areas and renting them out to generate steady passive income while expecting your property value to increase further and holding them regardless of market performance. This can be favorable given Bali’s ever-thriving tourism industry where there is always a strong need for rentals, especially in hotspots like Seminyak, Ubud, and Canggu. This means you can enjoy reliable rental property ROI from the long-term appreciation of your property, especially as the real estate market expands with better infrastructure and more foreign interest.

The key to success with this strategy is picking the best location and type of property for passive income generation and knowing your personal risk appetite as an investor. Villas, apartments, and land in developing areas usually see quicker appreciation, leading to better capital gains. Plus, rental yields are solid thanks to the constant flow of tourists throughout the year. Just make sure to do your end on researching the market, understand local ownership regulations, and team up with trustworthy agencies to reduce risks and boost your property returns.

Flipping Properties and BRRRR (Buy, Rehab, Rent, Refinance, Repeat) Strategy

Besides everything in this list, you may also want to consider the flipping properties or the BRRRR (Buy, Rehab, Rent, Refinance, Repeat) strategy. Although they may appear alike, they generate wealth through different approaches.

Flipping properties involves buying undervalued or old properties, updating them, and subsequently selling them at a significantly higher price, thus creating passive income. Conversely, by using the BRRRR approach, investors can acquire properties, renovate them, and subsequently lease them, generating a consistent flow of income. When the value of a property rises from renovations and market growth, you can refinance by pulling out the equity, then using that money to buy additional properties, thus repeating the process. These approaches are especially ideal for Bali’s flourishing rental market, where the need for housing and accommodations remains consistently high.

BRRRR has a big advantage over flipping: if done properly, BRRRR can maintain heightened cash flow potential, whereas flipping is just a one-time deal. Considering Bali’s property prices, the key is to enter the rental market and concentrate on popular or emerging areas where properties consistently attract interest and seldom remain vacant.

For seasoned investors, combining these two approaches can be quite easy. You can flip properties for quick cash and apply the BRRRR method to generate a reliable passive income stream, assisting you in establishing a solid and lucrative real estate portfolio in Bali. Of course, it also comes with some risks and uncertainties as Fix-and-Flip often provides rapid, although occasionally erratic, financial returns. In the end, your decision regarding these strategies will hinge on your overall risk tolerance and whether you are targeting long-term growth in your portfolio or seeking to achieve short-term profit generation.

consistently high.

Pay 25% of Your Property Straight From Rental Profit

Reduce the financial burden. Use your own villa’s rental income to pay down your investment cost for optimal cash flow and long-term returns.

Best Locations for Passive Income in Bali

When investing in passive income properties, finding the right location is key. Bali offers a wide range of areas, each catering to different investment goals. Here are some of the best locations for maximum returns:

Canggu

Known as Bali’s trendiest hotspot, Canggu attracts a mix of digital nomads, expatriates, and tourists with its café culture, co-working spaces, and beachside charm. This vibrant locale is ideal for long-term rentals and vacation homes, with high demand for properties such as villas, apartments, co-living spaces,and commercial units.

Seminyak

As one of Bali’s most established property markets, Seminyak is synonymous with luxury. With high-end boutiques, fine dining establishments, and beach clubs continuing to attract high net worth visitors, it is clear that properties here are on the expensive side of the spectrum. However, investing in Seminyak properties can still give you your well-deserved rental ROI due to constant demand for both short-term vacation and long-term rentals.

Kuta

Kuta is ideal for budget-conscious travelers, offering affordable property options and proximity to popular tourist attractions like Taman Ayun Temple, Ngurah Rai International Airport, Seminyak, and numerous southern beaches perfect for surfing. Its lively nightlife and relaxed atmosphere appeal to a broad range of visitors, especially the backpackers and families on a budget, ensuring steady demand for accommodations. With property prices lower than trendier hotspots like Canggu and Seminyak, investors can have a very solid chance for better returns on investment, particularly with short-term rentals that cater to the constant stream of tourists coming to Bali.

Uluwatu

Uluwatu’s stunning cliffside views and world-renowned surf spots make it a prime destination for luxury villas and boutique resorts. Ideal for investors aiming to attract high-end travelers, Uluwatu offers properties at more accessible prices compared to established areas like Canggu and Seminyak, all while delivering unparalleled natural beauty and tranquility.

Ubud

Known as Bali’s cultural and wellness epicenter, Ubud is a top choice for those seeking a peaceful and nature-rich setting. Properties here cater to expats, wellness enthusiasts, and digital nomads, making it an excellent location for rental properties focused on retreats, yoga centers, boutique accommodations, or eco-villas. With a stable rental market and relatively lower competition, Ubud is particularly attractive to new investors looking to enter Bali’s property market.

Nyanyi

Nyanyi is an up-and-coming area that offers the charm of Bali’s untouched landscapes while being close to the bustling hubs of Canggu and Seminyak. Known for its tranquil rice fields and proximity to the beach, Nyanyi is gaining popularity among investors seeking affordable entry points into Bali’s real estate market aside from Ubud. Its potential for value appreciation and growing demand for vacation rentals make it a hidden gem for both short-term and long-term investment strategies.

Ways to Ensure Real Estate Cash Flow in Bali

Conduct Thorough Market Research

The first thing you need to do when starting your property investment journey in Bali is to do comprehensive market research to understand real estate demand and trends. Explore well-known places such as Canggu, Seminyak, and Ubud, which attract many tourists and expats, but also consider rising locations like Cemagi, Sidemen, and Nyanyi, which provide affordable options and significant growth potential. Your goal should be to identify locations that align with your investment objectives, whether you seek steady rental income or are focused on long-term appreciation in value. Additionally, consider what kind of property aligns with your strategy—villas, apartments, or studios—depending on your target audience.

Understand Costs and Fees

Understanding the associated costs, hidden or not, and fees is crucial when investing in Bali’s real estate market. If you’re a foreign investor, one major thing to think about is the legal setup. You might need to establish a PT PMA (foreign investment company) for long-term property ownership, and that comes with its own legal and financial expenses.

On top of that, you’ll need to account for management fees, which typically range between 15-20% of your rental income. These cover essential services such as property maintenance, guest services, and operational management, which are essential for ensuring a smooth rental experience and a consistent flow of passive income.

Build a Sustainable Rental Model

Building a sustainable rental model is key to generating consistent passive income. Bali supports diverse rental strategies, from short-term vacation rentals targeting tourists to long-term rentals catering to expatriates and digital nomads. Short-term rentals, especially those in high-demand areas near beaches or popular tourist attractions can yield higher returns but may require more intensive management, while long-term rentals provide stability with less oversight.

With that in mind, customize your property’s services according to these models, ensuring it meets the unique demands of Bali’s varied tourism market. Additionally, consider adding amenities that are extremely attractive to visitors, like private swimming pools, wellness areas, or closeness to well-known attractions to enhance allure.

Consult Local Experts

Navigating the complexities of Bali’s real estate market is easier with the help of local professionals. It’s advisable to consult experienced real estate agents specializing in foreign investments to prevent typical mistakes and make well-informed choices. These experts will help you navigate the intricacies of the local market, negotiate prices, and find properties that suit your needs. Additionally, working with financial advisors is crucial for comprehending the broader financial implications of your investment, from tax regulations and financing options to projecting returns and crafting a solid investment strategy.

Ensure Legal Compliance

Lastly, understanding legal regulations is essential, especially when you’re trying to enter Bali’s property market. Foreign ownership laws in Indonesia are restrictive, so understanding legal frameworks is crucial. In general, foreigners cannot own a freehold property directly. They can, however, invest through leasehold agreements or set up a PT PMA, a foreign investment company.

It’s also recommended to seek legal counsel to obtain the necessary licenses to legally operate as a rental property. These licenses include rental permits, safety certifications, and other local requirements that may vary by location. Adhering to these regulations protects you from potential legal issues down the road and lays the foundation for a successful property portfolio in Bali.

Challenges of Investing in Bali’s Passive Income Property Market

While Bali is a promising location for passive income property investments, there are several challenges that investors must navigate to ensure their success. Understanding these challenges will help you prepare for potential hurdles and make informed decisions that align with your financial goals.

Navigating Foreign Ownership Restrictions

Foreign investors in Bali face strict legal limitations as Indonesian law prohibits direct land ownership by non-citizens. Market entry is only possible through leasehold agreements or PT PMA (a foreign investment company) structures, but these involve complex processes, additional costs, and ongoing regulatory oversight. Therefore, it’s essential for investors to work with local legal experts who can help navigate these ownership challenges and ensure compliance with Indonesian property laws.

Understanding and Budgeting for Associated Costs

Another challenge when investing in Bali real estate is understanding and budgeting for the various costs associated with property ownership. Beyond the initial purchase price, investors need to factor in recurring expenses such as taxes, property maintenance fees, and management costs. Properly identifying and planning for these costs is essential to maintaining the viability of your investment over time.

Market Volatility and Economic Conditions

Like any property market, Bali’s real estate market is not immune to fluctuations caused by market volatility and broader economic shifts. Factors such as changes in tourism trends, government policies, and global economic changes can significantly influence the demand for rental properties.

Despite Bali’s enduring popularity as a tourist destination, investors should anticipate fluctuations and plan for potential market downturns or unexpected challenges. Diversifying your investment strategy and focusing on long-term value appreciation can help mitigate some of these risks. By addressing these challenges head-on and understanding the intricacies of foreign ownership laws, costs, and market dynamics, investors can better position themselves to capitalize on Bali’s lucrative property market for passive income.

Experience Peace of Mind With Our 5-Year Warranty

Relax knowing your property is backed by a full 5-year warranty, supported by a team with over 25 years of shared real estate experience.

FAQ

Yes, foreigners can own property in Bali, but there are legal restrictions. Usually, foreign investors could go into leasehold agreements or acquire land through an Indonesian nominee structure. It’s also best to consider working with a reputable lawyer or property to ensure all the legal requirements are met.

The costs of purchasing a piece of property in Bali entail the price of the property, notary and legal fees, taxes, and sometimes maintenance costs. Leasehold properties are also cheaper than freehold property, but often need to be renewed after a fixed term.

Balinese rental market stays healthy throughout the year with a steady influx of international tourists. Demand for vacation rentals picks up in months when holidays and festivals are in full swing while expats and digital nomads usually like to secure longer-term rentals during the low season.

Bali’s property market comes with risks and dangers from fluctuating tourism trends, regulatory changes, and improper legal documentation. Proper due diligence and working with experienced real estate agents are the best ways to mitigate risks.

Properties such as short-term vacation rentals like villas and apartments, environmentally-friendly accommodations, and boutique commercial spaces such as cafes or yoga studios are ideal for passive income investments in Bali. Choosing properties in high-demand areas like Canggu, Uluwatu, Seminyak, Ubud, or Nyanyi will further enhance these income potential.

Enter Bali’s Property Market and Unlock Passive Income Opportunities Today!

Bali remains a prime destination for passive income property investments, with its natural beauty, thriving tourism industry, and favorable climate for investment. With its growing tourism industry, affordable market entry, strong rental property ROI and diverse property options to achieve consistent real estate cash flow, Bali offers a wealth of opportunities for savvy investors. Whether you’re interested in short-term rental properties, commercial ventures, or long-term buy-and-hold strategies, Bali offers the right environment for profitable, sustainable real estate ventures and growth in your investment portfolio.

Rasmus Holst is a serial entrepreneur and Co-Founder of COCO Development Group, where he helps drive innovation and growth through strategic business development. He is also the Co-Founder of Estate of Bali and Regnskabshelten.dk, Denmark’s fastest-growing accounting firm, which grew to 35 employees and generated $2.5M in turnover in 2023. Rasmus is passionate about building businesses that create long-term value and impact.